-

BzMarketing

-

Core Products

-

Liquidity

-

Turnkey Solutions

-

Crypto Processing

-

Money Management

BzMarketing

Our core products are spearheaded by our dedicated team of engineers delivering ground-breaking solutions to FX/Crypto/Securities brokers and Spot/Margin exchanges.

BzMarketing

Core Products

Our core products are spearheaded by our dedicated team of engineers delivering ground-breaking solutions to FX/Crypto/Securities brokers and Spot/Margin exchanges.

Trading Platforms

Core

Software Soluions & Services

Liquidity

We deliver one of the deepest liquidity pools for FX, Metals, Crypto and CFDs. Leading Crypto CFD liquidity provider based on market research with 100+ trading pairs.

Margin

CFDs

Specifications

Turnkey Solutions

Choose from our wide range of bespoke solutions designed for whatever type of financial business structure is required including brokerage, exchange and wallets.

Turnkey Brokerage

Turnkey Exchange

Crypto Processing

We are experts in blockchain payments including white label crypto processing solutions and are recognised as one of the go-to providers in the industry.

Blockchain Payments Solutions

Money Management

We offer a range of products enabling you to offer your clients a choice of proven money management solutions for investment or trading purposes.

BZCopy Investment Platforms

Prime of Prime FOREX Liquidity

The deepest liquidity pool in the FOREX marketBzBroker uses the information you provide to us to contact you about our relevant content, products and services. For more information, check out our Privacy Policy.

FOREX Liquidity

Spreads From

0

Margin Requirements

1%

Trading Hours

24/5

7

Technical Support

24/7

LIQUIDITY TAILORED TO RUN THIS MARKET

Genuine Prime of Prime Pricing

Get competitive STP pricing for Forex pairs as well as other trading instruments and asset classes.

What is Prime of Prime?

Margin Account

1

Access To

7markets

Instruments Up To

700

12ms

Technical Support

24/7

Prime of Prime Flow

directed towards us. This ensures we receive the best aggregated pricing available for our clients that is uniquely

A platform combining the features of margin and spot trading in one system powered by BzBroker.

A platform combining the features of margin and spot trading in one system powered by BzBroker.

Prime of Prime Flow

Liquidity Makers

Collateralization layer

Aggregation & Routing.

- Aggregartion

- Routing

- Matching

- Execution

Single Margin Account

Liquidity

Distribution

Venues

LIQUIDITY TAILORED TO RUN THIS MARKET

Genuine Prime of Prime Pricing

Get competitive STP pricing for Forex pairs as well as other trading instruments and asset classes.

Compare Prime of Prime Liquidity with others

| Features | Single LP | Prime of Prime | Several LPs |

| Single margin account model | |||

| Simple risk management system | |||

| Multiple types of liquidity | |||

| Aggregated liquidity in one stream | |||

| Full netting system | |||

| Single margin requirements | |||

| Single commission structure payments | |||

| Competitive spreads and volumes | |||

| Reliable liquidity stream with multiple backups | |||

| Protection against changes in trading conditions | |||

| Risk counterparty | HIGH | LOW | MEDIUM |

Aggregation & Distribution

Liquidity Makers | Liquidity Aggregators | Liquidity Venues | Liquidity Takers |

|

|

| ||||||

X-Core X-Core |  Hub Hub |  Hub Hub | ||||||

|

|

| ||||||

| PXM X-CORE | White Labels | FX Brokers | OZ Hub | Crypto Brokers | Liquidity Providers | FIX API Clients | Crypto Exchanges | Bridge Providers |

Settlement

Reduce your risk

USD based

client accounts

USDT based

client accounts

JPY based

client accounts

EUR based

client accounts

ETH based

client accounts

XRP based

client accounts

BTC based

client accounts

BNB based

client accounts

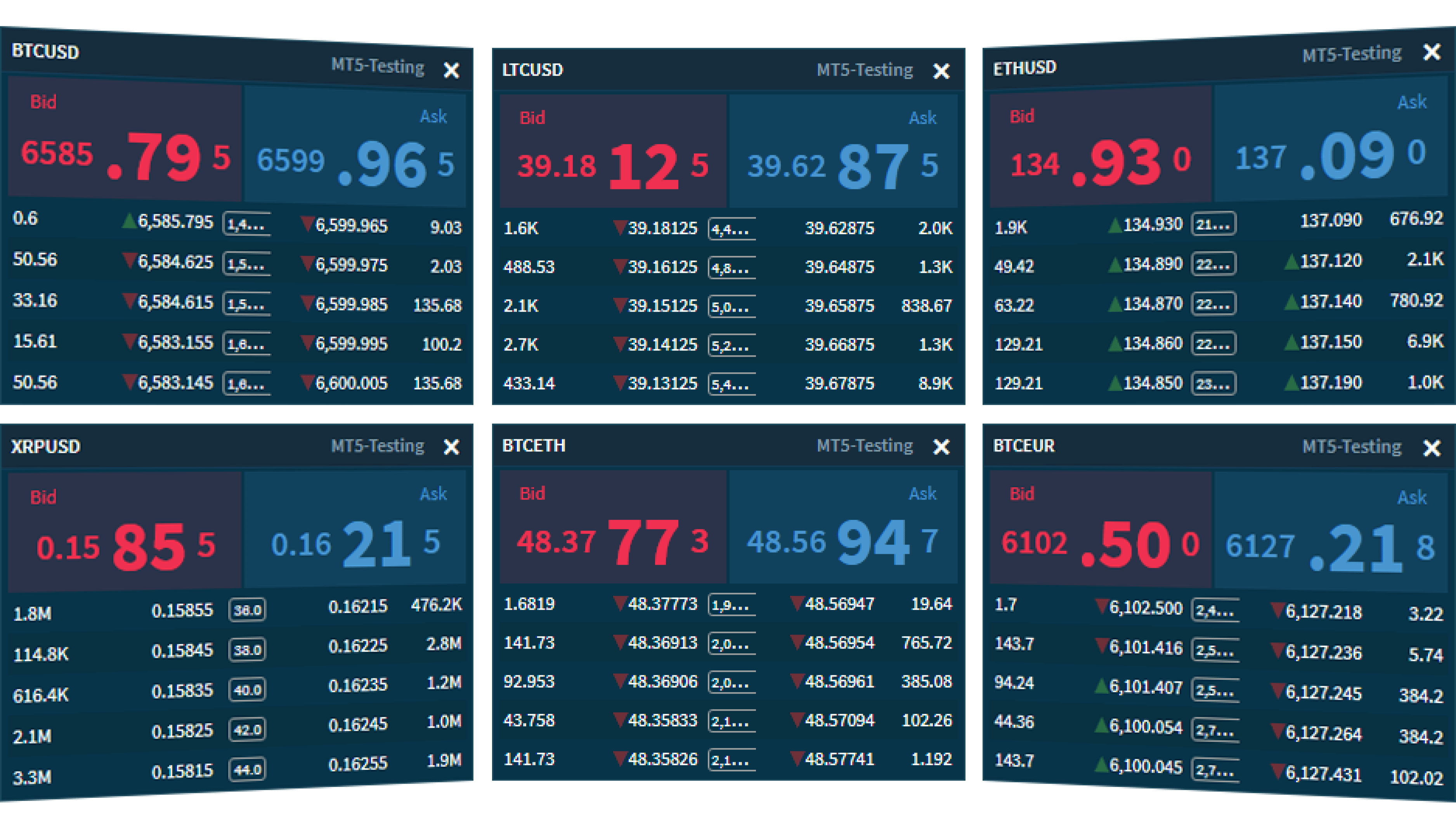

Multicurrency based margin accounts allow brokers to minimize volatile risks between clients’ equity and brokers’ equity. Margin accounts can be denominated in any currency from B2Broker’s liquidity, including cryptocurrencies. Client accounts in different currencies which are correlated to each other can be connected to one margin account. BNB and BTC based accounts can easily work with a BTC based margin account with minimal risk on volatility differences between the two currencies, for example.

The example above contains a complete diversification for the base currencies of customer groups, according to margin accounts based on the same base currencies. In this case, brokers will work with the same amount of capital as their clients, without risking volatility for each currency.

In a multicurrency nominated margin account model the broker needs to control the equity on all his margin accounts in order to provide execution for all his clients. This means the broker has to keep more funds – close to 100% of client funds, on his margin accounts to avoid rejections for client orders due to insufficient funds.

700 trading products7 asset classes

Wide connectivity

Get your Prime Liquidity

We are here to provide you with the best liquidity solutions tailored to your exact requirements. Contact us now.

B2Broker uses the information you provide to us to contact you about our relevant content, products and services. For more information, check out our Privacy Policy.

Advanced trading platforms and APIs

Standard protocol that allows communication between a client, trader, investment fund, or broker and our platforms.

FIX API is used by numerous banks, prime brokers, and hedge funds to operate in real-time mode.

Traders, investors and brokers can create custom trading applications, integrate into our platforms and build algo trading systems. Calls can be made in any language that supports a standard HTTP REST API on request.

Includes live streaming and historical prices for live trade operations. It is scalable, light and robust and is compatible with any Java-compliant operating system.

No set-up fee. No volume fee.

Cutting-edge infrastructure

12ms

12msTime for IT infrastructure setup

Physical proximity to all central trade servers of major exchanges, liquidity providers, banks and other financial institutions, allows us to minimize trade request up to a hundredth of a millisecond.

For large brokers, it is recommended to deploy anti-DDOS high-defense servers to effectively target targeted DDOS attacks.

All servers use strict security policies to protect against malicious attacks, intrusions, and cyber attacks.

A backup solution for multi-user systems with no downtime required to perform the backup.

Data centre facilities providing housing for servers with managed services to support our clients.

A standby mode is ready to take over the load from a failing system or scheduled down time.

Get connected in 5 minutes

and any other trading platforms via FIX API

integration in just 14 days

Get your Prime Liquidity

We are here to provide you with the best liquidity solutions tailored to your exact requirements. Contact us now.

B2Broker uses the information you provide to us to contact you about our relevant content, products and services. For more information, check out our Privacy Policy.

Market Depth and Liquidity pool

Liquidity tailored for all business models

- SAAS Core Products

- Liquidity

- Useful Links

- White Label Trading Platforms

- Turnkey Exchange

- Corporate Services

- Money Management

- Turnkey Brokerage

- Crypto Processing

- Software Solutions/Services

- Public

- Company

- Fellowship

- Education

© Copyright 2023 BzBroker. All rights reserved. BzBroker is a joint venture aiming to serve clients, develop fintech, and provide services through various legal entities and affiliates. We do not guarantee the accuracy of the content on this Website or its availability. BzBroker and its affiliates are not responsible for any loss or damage related to your use of the Website. Please review our legal documents for more information. This Website is for informational purposes only and does not constitute an offer for financial products. Use the Website at your own risk.